In a world where compliance is often seen as a burden, AI can become your most trusted advisor – quietly, constantly ensuring your organisation stays ahead of risk while unlocking the value hidden in your data.

If your last impression of AI was the early “hallucination” headlines around ChatGPT, that might sound hard to believe. But in this post, we’ll show you that individually tailored and properly governed AI has the power to make compliance seamless, auditable, and strategically valuable. Leaders who embrace this shift won’t just keep regulators satisfied; they’ll build trust, agility, and growth on a foundation of governed data.

The challenge is that in many organisations, compliance has long been treated as the opposite of agility. Processes are resource-heavy, rigid, and often reduced to box-ticking. At the same time, data strategy itself is rarely a C-level priority. Too often, nobody takes responsibility for the full data picture, and governance projects get passed around like “hot potatoes.”

The risks of poor governance are real. AI trained on uncontrolled data doesn’t just deliver flawed results – it can create reputational and regulatory exposure. Consider a simple example: if your dataset shows a correlation between poor leadership scores and higher sick-day absence, that might look like a clear signal. But unless the data is properly governed and interpreted, the insight could be meaningless – or worse, misleading. AI works the same way: without oversight, biased or low-quality data produces outputs that appear convincing but collapse under scrutiny.

Yet the reality is clear: data is now a decisive business asset. Handled well, it fuels innovation and competitive advantage. Handled badly, it creates reputational and regulatory risk. That’s why data governance and GRC need a Business Class upgrade – one that takes full advantage of AI.

Because, done right, compliance doesn’t slow you down – it helps you move faster, and with more confidence.

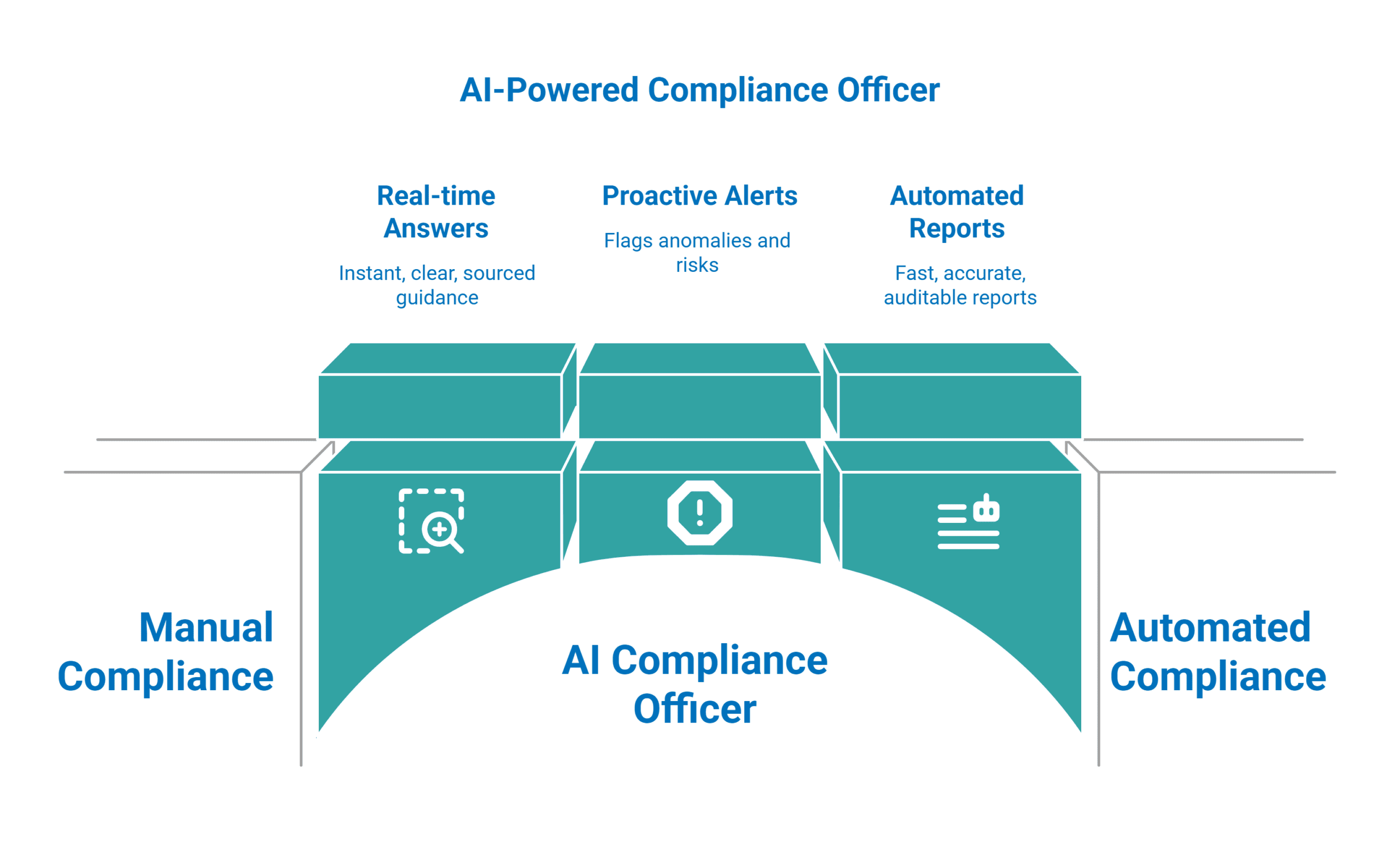

Inside the AI-Powered Compliance Officer

Ask any leader what comes to mind when they hear the word “compliance” and you won’t need an AI to predict the answers: endless reporting, fragmented responsibilities, and the sense that the real work of growth is being slowed down by paperwork. For many organisations, staying compliant feels like playing with a rulebook that never stops changing.

This is exactly the burden the wikima4 AI-powered Compliance Officer, part of the mesaforte.Compliance.Suite, was built to remove.

Imagine having a colleague whose only job is to know every relevant regulation, watch for emerging risks, and keep the organisation audit-ready at all times. This “digital compliance officer” never takes a holiday, never loses track of a detail, and never tires of answering the same question for the hundredth time.

Here’s how it works in practice:

- Real-time answers – Instead of hunting through hundreds of pages of guidance or phoning an external advisor, leaders can simply ask a question. Does this reporting requirement apply to us? What threshold triggers an audit? The system responds instantly with clear, sourced guidance.

- Proactive alerts – Instead of finding out about a problem when regulators are already knocking at the door, the AI-powered Compliance Officer flags anomalies and risks the moment they appear. Think of it as the difference between seeing smoke as it starts to rise versus waiting until a fire engine is parked outside.

- Automated reports – What once took days of manual work – cross-checking spreadsheets, reconciling data, formatting evidence – can now be generated in moments. Reports are not only faster; they’re more accurate, fully auditable, and consistent across the organisation.

The result isn’t the same for everyone. Each role experiences the benefit differently:

- Board members get oversight and assurance. They can see, in plain language, that the organisation is meeting its obligations.

- CFOs gain confidence that financial reporting stands up to scrutiny, without a scramble at year-end.

- Compliance Officers themselves are freed from the grind of manual checking (and being asked the same questions by multiple interested parties). Instead of acting as fire-fighters, they become proactive guardians of control.

- Application Owners no longer treat compliance as a separate task. It is embedded into the daily operation of their systems – seamlessly and invisibly.

For leadership, the transformation is profound. Instead of compliance being a drag on decision-making, it becomes a source of clarity. Instead of waiting for annual audits, assurance is continuous. Instead of seeing compliance as a necessary cost, they begin to see it as a strategic enabler – because they have an AI colleague that lets them move faster, with greater conviction.

The lesson is simple: when compliance is embedded into daily operations through governed AI, it no longer feels like a brake. It becomes the steering wheel – quietly keeping the organisation on course, while leaders focus on where they want to go next.

Leveraging AI for Fairness, Accuracy and Trust

AI thrives on data. But when no one takes responsibility for the whole picture, quantity quickly overwhelms quality. This is the Data Owner Dilemma: every team has its own slice of the truth, but nobody is accountable for the integrity of the full dataset. In that environment, governance projects get passed around like hot potatoes, and gaps creep in where bias, inconsistency, or errors can hide.

The risks become obvious the moment AI enters the picture. An algorithm will faithfully learn whatever it is given – but if the data is skewed, the results will be too. Outputs may look persuasive, but without governance they are often flawed, opaque, or impossible to explain.

A Cautionary Tale

There is no shortage of examples where ungoverned or opaque AI has created problems in the real world. One of the most high-profile came in 2019, when tech entrepreneur David Heinemeier Hansson discovered that his Apple Card credit limit was 20 times higher than his wife’s – despite her having a stronger credit score and shared financial assets. Apple co-founder Steve Wozniak reported a similar experience.

The public backlash was immediate, and regulators stepped in. The New York State Department of Financial Services launched an investigation into the Apple Card’s underwriting model, managed by Goldman Sachs. The final report confirmed that no evidence of intentional or disparate impact discrimination was found. But the bigger issue was transparency. Customers were left confused by arbitrary-seeming limits, and they had no clear way to understand or appeal the algorithm’s decisions. This undoubtedly caused a reputational hit for Apple.

So, the lesson is clear: even if an algorithm isn’t deliberately biased, the absence of explainability and customer-centric governance can erode trust, trigger regulatory scrutiny, and damage reputations.

The Role of AI Governance

Governance changes that story. A digital compliance officer validates and tags data before AI consumes it, catching biases and anomalies at source. Built-in audit trails then ensure every decision is explainable and defensible. And with consistent rules applied, outputs become not only faster but also fairer and more accurate.

That is exactly what the wikima4 AI-powered Compliance Officer delivers. It closes the gap left by the Data Owner Dilemma, acting as the single layer of accountability across fragmented systems. It ensures that leaders aren’t relying on dashboards that look convincing but collapse under scrutiny. Instead, they gain insights that are accurate, ethical, and auditable.

For leadership, the outcome is transformative: decisions that move at the speed of business, but with the assurance that they are fair, explainable, and trusted by regulators and stakeholders alike. In short, AI that is not just powerful, but principled.

AI Data Governance and Compliance as a Growth Driver

For years, compliance has been treated as a cost of doing business – something that slowed teams down while keeping regulators satisfied. But with AI-powered data governance, that equation flips. Compliance stops being a defensive necessity and starts becoming a growth driver across the four lenses that matter most to leadership: revenue, innovation, efficiency, and trust.

Revenue Enablement

When approvals move faster and launches are compliant by design, organizations can bring new products to market sooner. Delays from regulatory uncertainty or manual checks are reduced, and the risk of costly fines or stop-orders is dramatically lower. In simple terms: governance keeps revenue on track, not stuck in limbo.

Innovation

Innovation thrives when people have the headspace to focus on value creation rather than admin. By stripping away repetitive compliance work, the AI-powered Compliance Officer frees teams to experiment and build. And because every dataset is bias-checked and governed before AI consumes it, leaders can unlock more creative – and safer – uses of data without fear of reputational risk.

Efficiency

Conventional compliance processes are plagued by duplication and frantic end-of-deadline effort. AI-powered monitoring changes that. Continuous checks prevent small issues from snowballing into expensive fixes, while automated reports cut preparation time for audits from days to minutes. The result is lower costs and higher productivity across the board.

A striking example comes from the U.S., where startup ConductorAI has built a platform that transforms government approval and compliance processes. Instead of weeks spent combing through dense policy documents, its AI reduces review cycles to minutes. The potential impact is huge: the U.S. Chamber of Commerce estimates that manual, paper-based compliance costs the federal government $38.7 billion every year.

Trust and Market Advantage

In today’s market, trust is a currency. Transparent and explainable controls don’t just satisfy regulators – they reassure customers and partners that your organization is acting responsibly. Ethical, governed AI sends a clear signal: this is a brand that doesn’t cut corners. Over time, that reputation becomes a competitive edge.

A Strategic Shift

Seen through these four lenses, compliance is no longer the speed bump it used to be. It becomes the engine of leadership ambition – enabling organisations to grow revenue, scale innovation, operate efficiently, and earn long-term trust.

And the first step is simple: measure where you are today. Try the free wikima4 checklist or self-audit tool to benchmark how far your compliance is supporting growth – and where it could be doing more.

Because when compliance becomes an enabler instead of an obstacle, leaders don’t just keep up with the pace of change – they set it.